In the ongoing debate over U.S. tax policy, the proposals from Vice President Kamala Harris and Republican nominee Donald Trump couldn’t be more different.

According to a new analysis from the Institute on Taxation and Economic Policy (ITEP), Harris’s tax agenda aims to relieve middle- and low-income families, while Trump’s plans would significantly benefit the wealthiest Americans and large corporations.

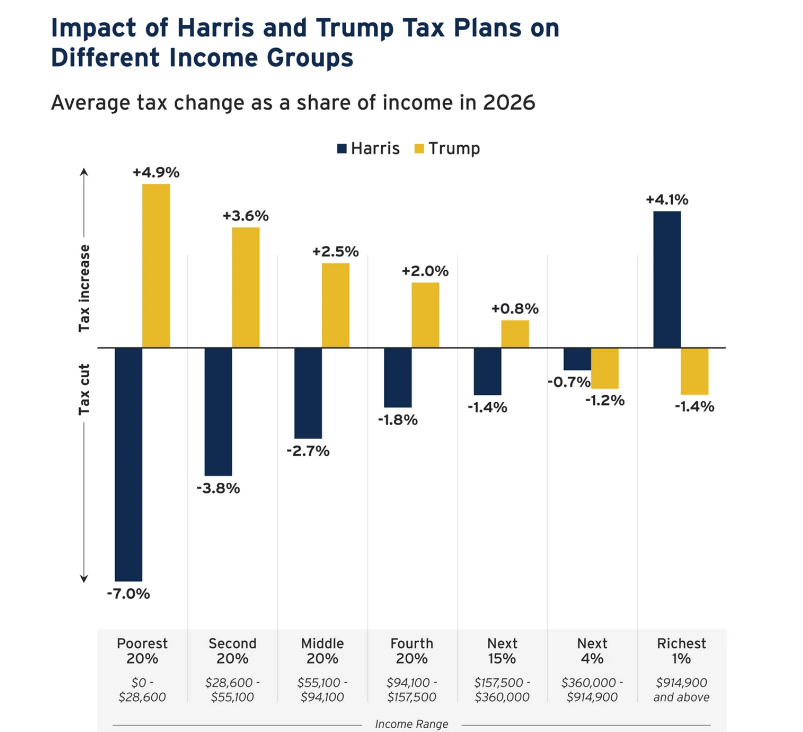

The ITEP report highlights the stark contrast between the two approaches. Under Trump’s tax proposals, the richest 5% of Americans would see their taxes cut, while middle- and low-income families would likely pay more.

In contrast, Harris’s tax policy would increase taxes on the wealthiest 1%—those earning nearly $1 million a year or more—while providing tax cuts to nearly every other income group.

“The difference between Harris and Trump on taxes is crystal clear,” said Amy Hanauer, executive director of ITEP. “Trump’s plan would widen inequality, forcing middle-income and low-income families to shoulder more of the tax burden while slashing taxes for the wealthiest.

Harris’s proposals would help most families by raising taxes on the richest 1% and reducing taxes for everyone else.”

What Harris’s Tax Proposals Mean for Americans

This Article Includes

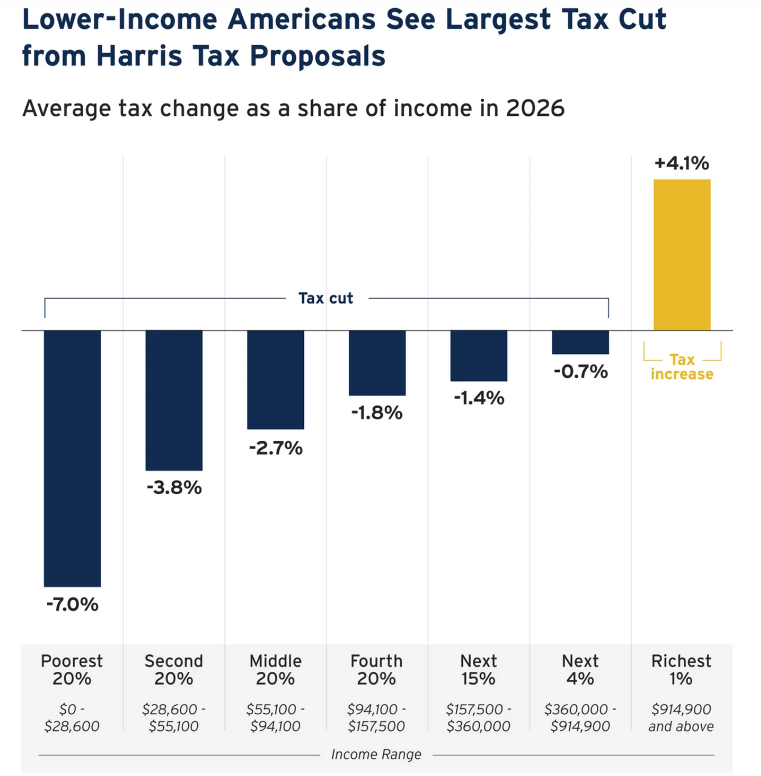

ITEP’s analysis shows that if Harris’s proposals were in effect by 2026, the richest 1% of Americans would face an average tax increase of 4.1% of their income. In dollar terms, that’s about $121,460 per year for the wealthiest Americans.

In stark contrast, the poorest 20% of Americans would see an average tax cut of $1,130, and the middle fifth of Americans would enjoy an average tax cut equal to 2.7% of their income. For the nation’s lowest-income earners, Harris’s plan represents a significant tax reduction of 7%, providing a meaningful boost to those who need it the most.

Specific Elements of Harris’s Plan

Harris’s tax proposals include several key elements aimed at benefiting middle-class and working families:

- Expansion of the Child Tax Credit: This would provide more financial support to families with children, directly reducing their tax burden.

- Extension of Elements from the 2017 Tax Law: While Trump’s 2017 tax law primarily benefited the wealthy, Harris aims to extend certain provisions that help Americans with incomes below $400,000.

- Medicare Tax Reforms: Harris would raise taxes on individuals earning more than $400,000 annually, helping fund healthcare reforms while leaving middle- and lower-income Americans unaffected.

These proposals reflect Harris’s goal of making the tax system more equitable, offering relief to those who need it most while ensuring that the wealthiest pay their fair share.

Trump’s Tax Cuts: A Boost for the Wealthy

In contrast, Trump’s tax proposals continue the legacy of his 2017 tax cuts, which overwhelmingly benefited the wealthiest Americans. According to the ITEP report, the 2017 Trump-GOP tax cuts added more than $2 trillion to the net worth of the nation’s billionaires, while providing minimal benefit to the average working-class American.

Steve Wamhoff, ITEP’s federal policy director, pointed out that Trump’s tax cuts primarily benefited the top 1% and foreign investors. “If you’re among the richest 1% who benefited greatly from the Trump tax cuts, you’d pay more under Harris’s plan,” said Wamhoff.

“But everyone else would pay less overall because Harris’s plan uses the tax code to help Americans with the costs of raising children, healthcare, housing, and other critical expenses.”

A Clear Choice for the Future

As Trump campaigns for a new round of tax cuts that favor the wealthy, Harris’s proposals stand as a counterpoint, focused on providing relief to working families and reducing income inequality.

The ITEP analysis shows that under Harris’s plan, most Americans would benefit, while the richest 1% would contribute more to the nation’s fiscal health.

In a country where the wealthiest 1% collectively own nearly $45 trillion in assets—an all-time high—Harris’s tax agenda seeks to rebalance the scales, offering financial support to millions of families.

Her proposals would not only cut taxes for most Americans but also ensure that the ultra-wealthy contribute their fair share to the nation’s economy.