How Trump’s Tariffs Could Help Certain U.S. Industries Thrive

As President-elect Donald Trump’s proposed tariffs continue to make headlines, concerns are mounting about the potential negative impacts on some of the country’s biggest corporations. Many multinational companies in the S&P 500 have diversified supply chains with significant exposure to China and other international markets, which could be hit hard by these tariffs.

However, for every company that stands to lose, there are others poised to benefit. According to David Bianco, Americas Chief Investment Officer at DWS Group, tariffs could actually stimulate growth in certain sectors of the U.S. economy by encouraging domestic consumption and investment.

With the U.S. economy increasingly shifting toward services, businesses today are less reliant on physical assets than in the past, making them less vulnerable to supply chain disruptions and tariff-related risks.

Technology and Software Industries Protected

In particular, some areas of the technology sector are well-positioned to remain unaffected. Companies that focus on software, cloud services, and digital platforms typically don’t rely on physical imports and have historically been insulated from protectionist policies. Bianco explained that industries like software as a service, internet services, social media, and digital technology are unlikely to feel much impact from tariffs.

The Financial Sector: A Big Winner

The financial sector, particularly banks, stands to benefit from Trump’s tariff policies. Since banks don’t depend on imports, they’re largely insulated from the effects of tariffs. Furthermore, many regional banks have minimal exposure to international revenues. Clayton Gardner, co-CEO of wealth management firm Titan, suggests that banks could also see a boost from potential deregulation under Trump’s administration.

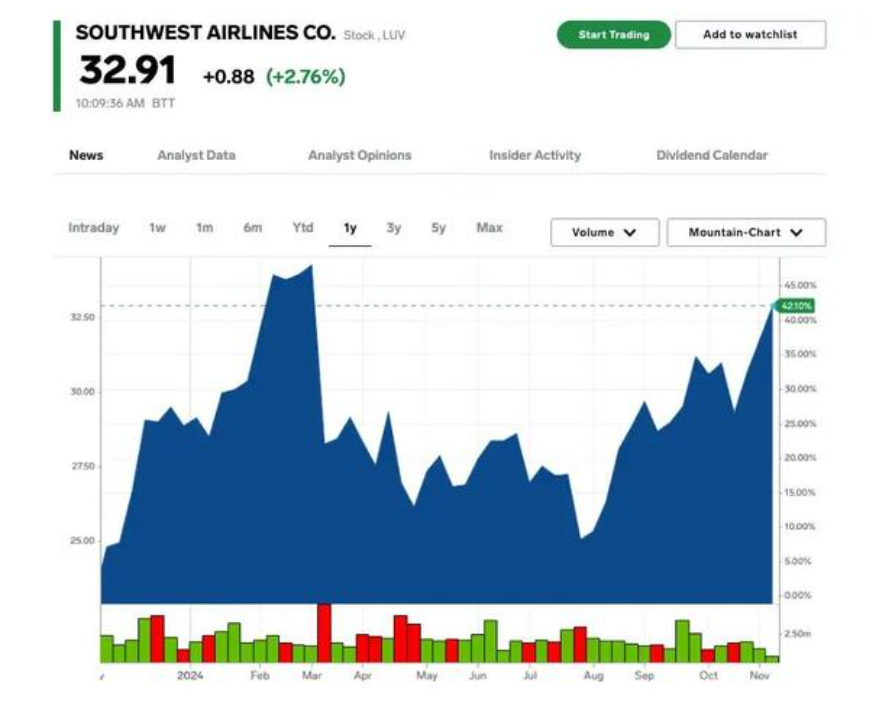

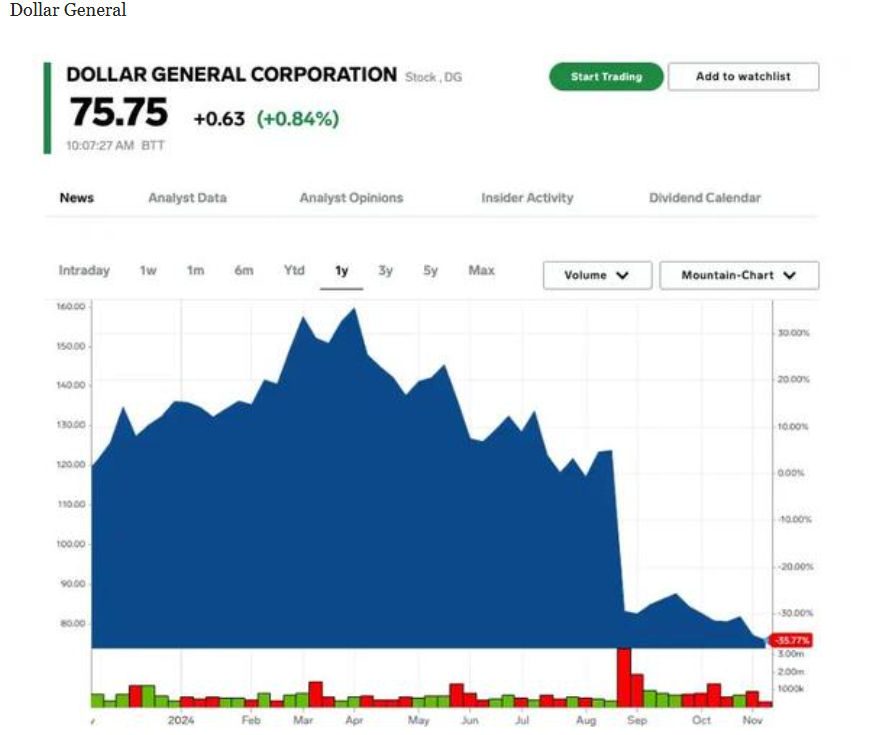

Gardner believes that low-margin, cyclical businesses with little international exposure will fare well under Trump’s policies. These businesses, which include grocery stores, dollar stores, home builders, and small airlines, are expected to see gains from reduced corporate taxes, deregulation, and a rise in domestic demand.

Small Manufacturers and Reshoring

Another group that could emerge as significant beneficiaries of Trump’s presidency are small manufacturers. According to Samuel Rines, macro strategist at WisdomTree, the tariffs will encourage companies to bring more production back to the U.S. After the pandemic, many manufacturers began reshoring, and the Trump administration’s policies are expected to provide additional incentives for this shift. Rines points to Kentucky and Tennessee, both of which have become major automobile manufacturing hubs, as examples of American manufacturing on the rise.

Rines also believes that the U.S. could see a resurgence in “higher-end manufacturing,” such as semiconductor production, which is critical to the development of artificial intelligence. With bipartisan support for legislation like the CHIPS Act, which aims to fund domestic semiconductor production, Rines anticipates that Trump will likely continue to back these popular policies, further boosting U.S. manufacturing.

In conclusion, while some industries may face challenges under Trump’s proposed tariffs, others, including tech companies, financial institutions, and small manufacturers, could thrive. The shifting dynamics in American business provide opportunities for growth, particularly in sectors with limited reliance on international trade.